We hear this question all the time — and it’s completely understandable. Electric scooters can be a significant investment, and the last thing you want is to be caught without insurance. When electric scooters first hit the market, insurance options were scarce or nonexistent. Thankfully, that’s changing as more providers begin offering coverage.

While it’s great to see progress, insurance options for e-scooters are still limited, and understanding the coverage can be confusing. This guide is here to help answer your most common questions: Do I need insurance for my electric scooter? What types of coverage are available? And how can you best protect yourself on the road?

Do You Need Insurance for an Electric Scooter?

This is the MOST important question of them all. Do you actually need it? If you’ve read our blog posts before - you can guess what we’ll say. Yup - it depends. Like everything, there’s no easy Yes or No answer, because it really depends on many different factors, including whether it’s required by law or not based on your location.

Electric scooter insurance is not universally required by law, but requirements vary widely depending on where you live. Some states or countries may mandate minimum liability coverage, while others have no specific scooter insurance laws.

Even if it’s not legally required, insurance is highly recommended. It can protect you financially if you’re involved in an accident, your scooter is stolen, or you cause damage to someone else’s property.

Types of Electric Scooter Insurance Coverage

So, let’s dive into the more complex side of electric scooter insurance — starting with the different types of e-scooter coverage. While the exact options depend on the insurer, these are the most common types we’ve found available:

Liability Coverage

The most essential type of protection, liability coverage pays for injuries or property damage you cause to others while riding. We all like to think accidents won’t happen — until they do. Having liability insurance ensures you’re not left with a hefty bill if the unexpected occurs.

Collision Coverage

This covers damage to your scooter after a crash, regardless of who’s at fault. Even with careful riding, accidents can happen — from hitting a hidden pothole to being struck by a distracted driver.

Theft Protection

This reimburses you if your scooter is stolen. Given that electric scooters are a common target, it’s a highly recommended add-on. Be sure to read the fine print — many insurers require you to use specific types of locks for the policy to be valid. In most cases, theft protection isn’t included in basic coverage, so you’ll need to request it.

Comprehensive Coverage

Covers damage from non-collision events like fire, vandalism, or natural disasters. This type of protection is about preparing for the unexpected, beyond just road incidents.

Personal Injury Protection

Covers your medical expenses if you’re injured while riding, regardless of fault. This can be especially important if you don’t have other health coverage in place.

💡 Tip: We haven’t found many policies dedicated solely to electric scooters — most are bundled with e-bike coverage or fall under motorcycle insurance. Knowing this can help you locate relevant policies more easily in your search.

Understanding Liability vs. Comprehensive Coverage

It’s crucial to know the difference:

-

Liability insurance protects others if you’re at fault in an accident.

-

Comprehensive and collision coverage protect you and your scooter from damage, theft, or unexpected events.

Many basic scooter insurance policies only include liability, so if you want full protection, be sure to explore comprehensive options.

What to Look for in an E-Scooter Insurance Policy

When choosing your policy, consider the following:

-

Does it meet your state or local scooter insurance requirements?

-

Are theft and vandalism covered?

-

What are the deductibles and coverage limits?

-

Does the insurer understand personal mobility insurance and cover scooters specifically?

-

Can you bundle scooter insurance with your auto or renters insurance?

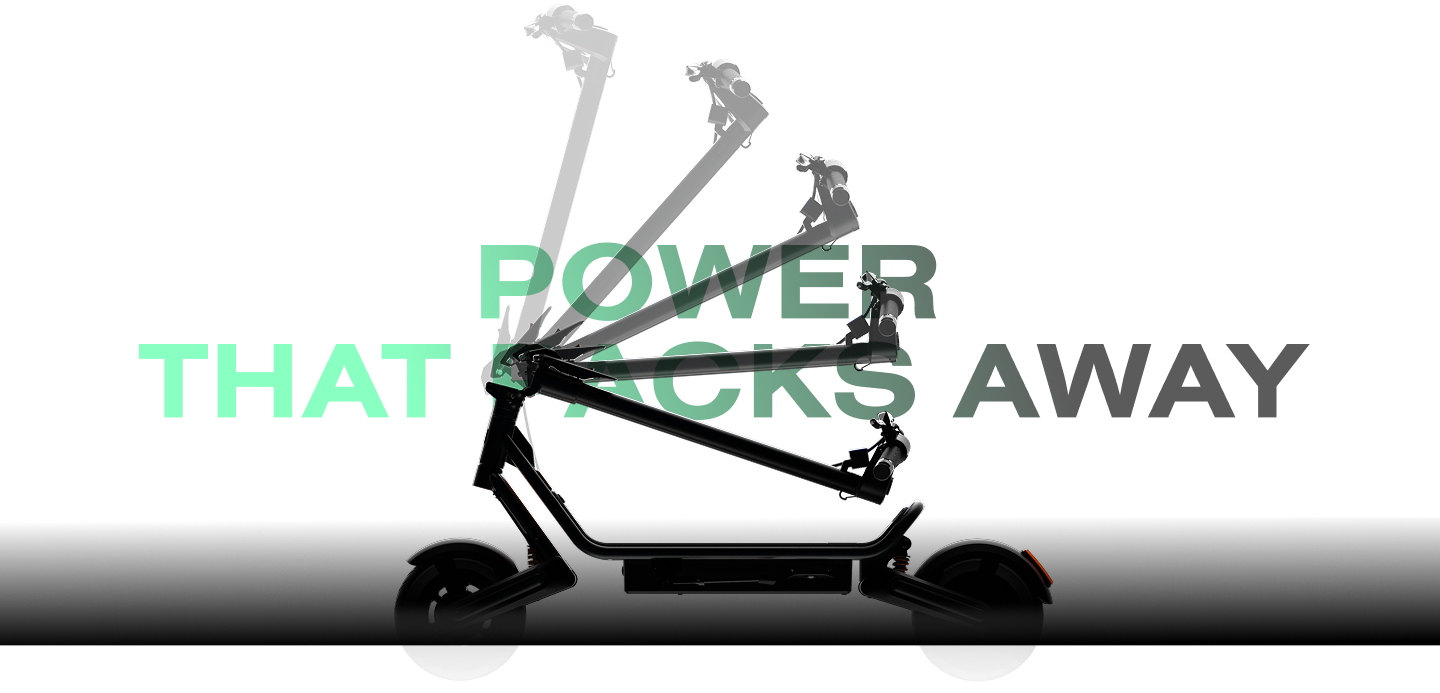

Apollo’s Approach to E-Scooter Safety and Risk Reduction

Apollo Scooters is committed to rider safety through innovation, education, and support. Beyond building safe scooters, we provide resources on safe riding habits and encourage responsible ownership. When combined with appropriate insurance, you can ride with confidence.

E-Scooter Insurance Companies

At the moment, there aren’t any insurers offering policies exclusively for e-scooters. However, there are several providers that include electric scooter coverage within broader plans, such as e-bike or motorcycle insurance. Here are a few we recommend exploring to find the right fit for your needs.

-

Reliant Insurance offers multiple types of insurance, but they do have one specifically for electric scooters with comprehensive coverage. There’s a lot of resources and support to help you get the right insurance.

-

Movin Ebikes specializes in e-bike and e-scooter insurance. This could be great because they know the specific needs that riders have. However, with smaller product offerings, pricing could be higher. We recommend you take a look to understand what you really need from insurance.

-

Pedal Power Bicycle Insurance Offers insurance for electric bikes and scooters, covering theft, damage, and liability. The only downside - they don’t offer coverage for riders in Quebec.

-

Sharp Insurance Provides guidance on electric bike and scooter insurance; they have multiple levels of coverage - a good option to look into.

FAQs About E-Scooter Insurance

Is electric scooter insurance required by law?

It depends on your location. Some places require liability insurance, others don’t. Always check local regulations.

What kind of insurance covers electric scooters?

Policies can include liability, collision, theft, and comprehensive coverage, either standalone or as part of personal mobility insurance.

Can I add my scooter to my existing policy?

Sometimes, yes. Check if your auto, homeowners, or renters policy covers e-scooters or allows adding them as a rider.

Does renters insurance cover electric scooters?

It may cover theft or damage but usually does not cover liability while riding.

How much does e-scooter insurance cost?

Costs vary by location, coverage, and scooter value but expect anywhere from $10 to $50 per month on average.